Navigating life’s financial terrain requires a skillful balance, especially when budgeting for various expenses. From the monthly obligations of utility bills to the unexpected outlay for HVAC repairs, understanding how to allocate funds efficiently is paramount. This guide aims to unveil strategies that optimize the payment process and ensure that each dollar stretches further, adapting seamlessly to your lifestyle needs. In this exploration, we’ll dive into how maximizing online payment solutions can streamline budget management, the significance of regular HVAC maintenance in preventing costly repairs, and tailoring your expenditure to align with personal preferences and goals. Keep reading to discover how you can master the art of budgeting for life’s many expenses, ensuring financial well-being and peace of mind.

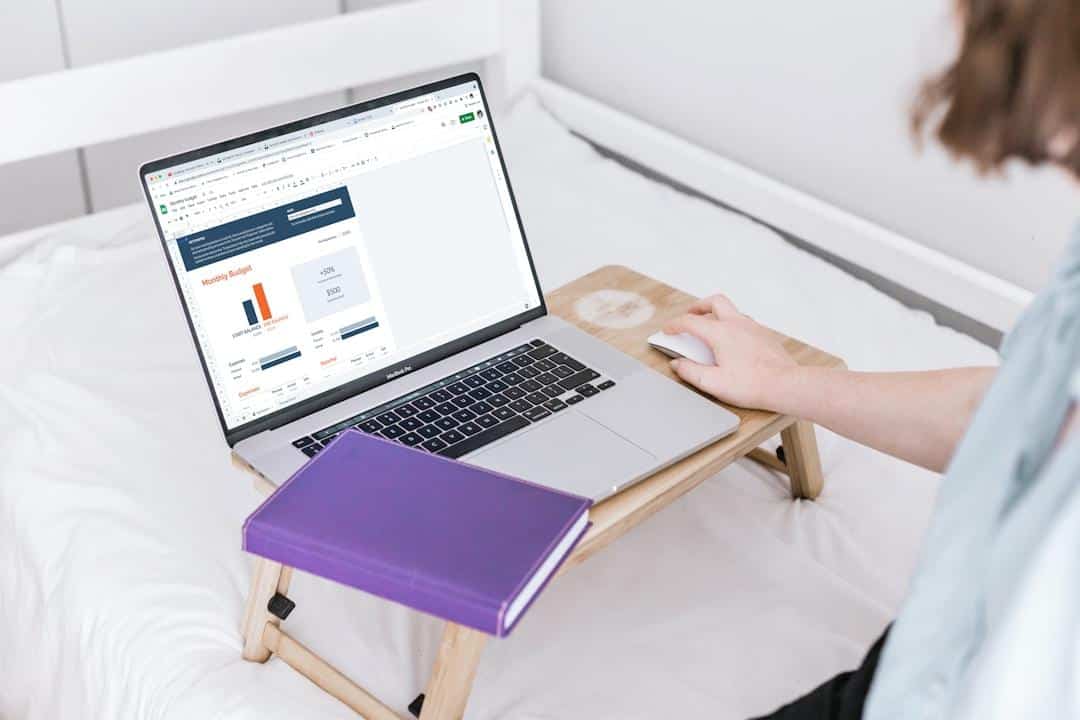

Maximizing Budgeting Efficiency: Harnessing the Power of Online Payments

Maximizing budgeting efficiency often hinges on leveraging the vast potential of online payments. Embracing these digital solutions allows individuals to streamline the management of their financial obligations, from utility bills to subscription services. It’s a strategic pivot that ensures every penny is accounted for without the manual hassle of traditional payment methods.

The question “Where can I pay my simple mobile bill?” is a prime example of how digital platforms simplify budget management. By consolidating multiple payment avenues into singular, accessible online portals, users can effortlessly keep track of their spending, ensuring they stay within their financial boundaries. This level of financial governance was hard to imagine in the age before digital transactions became commonplace.

Moreover, the agility afforded by online payments complements dynamic budgeting strategies. As financial goals shift and unexpected expenses emerge, the ability to rapidly adjust payments is indispensable. This agility ensures individuals can swiftly adapt to financial surprises, maintaining their budget’s integrity and keeping their financial health in check.

HVAC Maintenance: Navigating Costs and Ensuring Efficiency

HVAC maintenance emerges as a critical element in the complex puzzle of managing life’s expenses efficiently. It stands at the intersection of necessity and utility, requiring a strategic approach to ensure that systems run effectively without draining the budget. Recognizing the cost implications early and planning for regular check-ups can ward off unexpected financial strains.

Securing a balance between cost and efficiency in HVAC maintenance demands attention to scheduling and choosing the right service providers. Proactive measures, such as seasonal inspections and immediate repair of minor issues, prevent the snowballing costs associated with major breakdowns. This foresight into routine maintenance translates into long-term savings and sustains the system’s longevity.

Integrating HVAC maintenance into one’s broader financial planning framework underscores its importance. It’s a move that highlights the recognition of both immediate comfort and future fiscal well-being. By allotting funds for such upkeep, individuals can dodge the discomfort and expense of untimely malfunctions, ensuring a steady course toward their financial goals.

If you need reliable heating repair services, a simple Google search like “heating repair Palm Desert CA” can connect you with trusted professionals, offering peace of mind and prompt resolution to HVAC concerns.

Tailoring Your Budget: Customizing Expenses to Fit Your Lifestyle

Adapting one’s budget to align with one’s lifestyle demands a keen understanding of personal priorities and financial limitations. It’s about recognizing which expenses are non-negotiable and which can be adjusted or eliminated, ensuring a balance between desires and resources. This strategic customization turns budgeting from a constraining practice into a liberating one, offering a clear path to achieving personal and financial goals.

Creating a budget that mirrors one’s lifestyle involves meticulous planning and frequent reviews. As life evolves, so do financial needs and aspirations, necessitating adjustments to spending and saving habits. This dynamic approach allows individuals to stay on track with their objectives, whether saving for a vacation, investing in education, or preparing for retirement, making their financial plan as adaptable as their life.

Moreover, tailoring one’s budget to fit one’s lifestyle requires a judicious mix of restraint and indulgence. It emphasizes the importance of discerning spending, and allocating more to areas that enhance well-being and satisfaction while minimizing unnecessary expenditures. This method fosters a sense of control and confidence in financial decisions, underpinning a healthy economic life that reflects personal values and aspirations.

Overall, mastering the art of budgeting for life’s many expenses requires a multifaceted approach, encompassing strategic payment methods, proactive maintenance practices, and personalized financial planning. By harnessing the power of online payments, prioritizing HVAC maintenance, and tailoring expenditures to align with individual lifestyles, individuals can confidently navigate the financial landscape, ensuring both short-term stability and long-term prosperity.