A conventional loan is the most typical loan in the U.S., used to purchase a home. If you have a good credit history and a sizeable down payment, this loan can be a suitable option.

Conventional loans have to follow some government guidelines. For example, they align with loan limits set by the Federal Housing Finance Agency.

In this article, we will break down the most common situations for requesting a conventional loan and the minimum down payment you have to keep in mind. Let’s dive in!

Definition of Conventional Loan

A conventional loan is a type of mortgage that is not covered by insurance or government aid. While they adhere to law regulations, most of them come from private lenders and aren’t “backed” by government entities.

Conventional loans, unlikely instant cash loans online require private mortgage insurance (PMI) if you put less than 20% of the purchase price down.

PMI refers to an additional premium added to a regular monthly payment. It represents the protection of lenders in case borrowers delay or misses their payments.

Conventional Loan Categories

The main categories of conventional loans are:

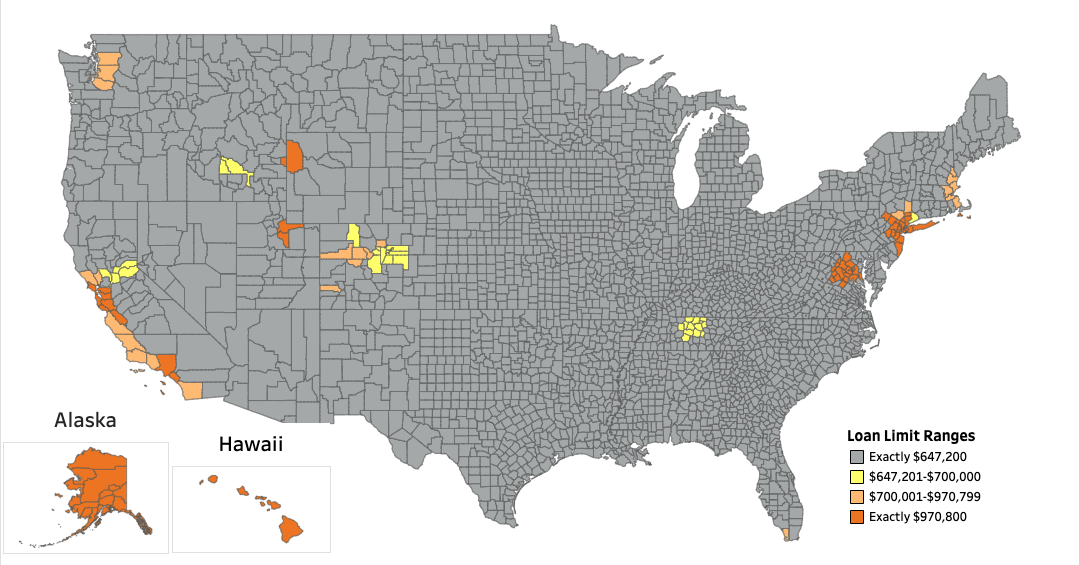

- Conforming loans: where the government sets the maximum loan amount. A conforming loan is the most common type of conventional loan, with an amount of up to $970,800 in high-cost countries. The conforming loan values differ by county and state: for example, the loan limit in Tennessee is $694,600 while being $854,450 in California.

Conforming Loan Limit Values for 2022

Non-conforming loans: the lower-standard loans. It doesn’t mean they are illegal but simplifies their major requirements. Eligibility, pricing, and features vary for different lenders, making it easier to find yourself an appropriate offer.

The non-conforming loans might be risky, as some of them are intended for an audience with poor credit scores.

For example, they might need minimum paperwork, or allow you to pay only interest. No matter how desperate your situation is, beware of risky features, and don’t fall for the mainstream offers easily.

What Is a Minimum Down Payment?

The suggested amount for a minimum down payment is 20% of the loan. However, it’s not a stable requirement, and the customers may lower it as much as they like (sometimes, even to 3%).

Having a 20% down payment, the borrowers pay less than those eligible for PMI. Let’s say, if your house costs $250,000, the monthly payment will be higher for the buyer with PMI by almost $309. It’s the PMI payment plus an interest expense.

For some people, it seems insignificant, but if you calculate the costs given to PMI annually, it’s almost $3,708 extra every year, and $55,620 over 15 years.

Keep in mind that you pay a PMI in case the 20% down payment is not applicable. Since every house buyer brings their financial position to a home loan, including their debt-to-income ratio, income, and credit score, there is no set minimum down payment for everyone.

Other Requirements for Conventional Loan

Conforming conventional mortgages follow the underwriting standards established by the two largest providers of mortgage financing, Freddie Mac and Fannie Mae.

Here’s the list of main requirements for you to consider before applying:

- Credit score: at least 620 is required to qualify. In addition, borrowers with at least 740 can make smaller down payments and receive the most enticing rates.

- DTI (Debt-to-Income) ratio: another critical factor for lenders. DTI shouldn’t be higher than 43% to pose as a reliable borrower. The lower it is, the more likely you’ll get approval for a full loan amount.

- Loan amount: for most counties, the minimum full loan amount is $647,200 in 2022 (or even higher for high-cost areas). If you believe the price of your property surpasses these sums, you might want to look into alternative financing options.

The origin of conventional loans implies them as good options for people with an attractive credit score.

However, there are cases when a conventional loan becomes a possibility for low-income borrowers to repair their credit history and become eligible for a higher amount.

If you’re not a good candidate for a traditional (conforming) type of loan, you’ll be likely to fit into the non-conforming loan requirements.

Types of Nonconforming Loans

A conventional loan is a good option for many people, but it might not work for all borrowers.

Before applying, you have to make sure you align with the main requirements. In case you’re not doing well with the numbers, talk to your realtor and financial advisor.

The alternative options (nonconforming loans) include:

- FHA (Federal Housing Administration): is a choice for borrowers having credit scores as low as 500.

- USDA (The U.S. Department of Agriculture): using a USDA loan, you can make as little as a $0 down payment without worrying about your credit history. USDA loans are great for rural buyers with moderate to low levels of income.

- The Department of VA (Veteran Affairs): in case you qualify, you may apply for VA loans, which are available to military service people and their families. VA loans don’t require a down loan payment, and you can apply for them over and over again.

The main reason why checking eligibility requirements before applying is that you may have some benefits you were not aware of.

If you belong to the military, or you are a rural buyer, you can significantly decrease your down payment without an obvious reason and, therefore, cut your expenses.

The Aftermath

A conventional loan requires a credit score of 620 or higher. Down payments on conventional loans are around 20%.

Conventional loans require a minimum down payment based on several factors, including the sale price and the borrower’s qualifications.

Make sure you’re eligible before sending an application. Consult with a realtor or financial advisor and calculate your monthly expenses.

Whatever you choose, remember to set your priorities. If this doesn’t work right now, it can work later. Don’t put yourself in braces just to fit into the loan requirements. Your financial health comes first, no matter what.